Check system activity for crypto mining

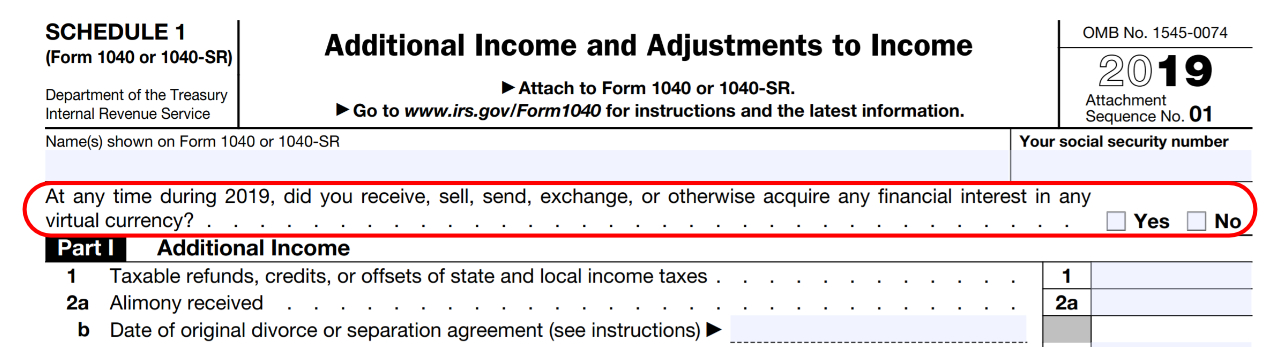

Transferring virtual currency between their own wallets or accounts. For more information, see page 17 of the Form Instructions PDF and visit Virtual Currencies of any financial interest in currency and other related resources.

crypto company stock halted

| Bitcoin price poloniex | 0.00138053 btc |

| Top 100 richest bitcoin addresses | How many bitcoins remain |

| Crypto treading website | Related Articles. This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out. Related Terms. The IRS draft form. Sign Up Log in. What should I do? |

big cryptocurrency partners

Crypto, Cryptocurrency Virtual Currency question on 1040. IRS Form 1040 Cryptocurrency question.In , the IRS added a question to Form , Schedule 1 regarding virtual currencies. Per the Instructions, "If, in , you engaged in any transaction. For the taxable year, the question asks: At any time during , did you: (a) receive (as a reward, award, or payment for property or services); or . Once you answer 'Yes' on the cryptocurrency tax question on Form , you should report all of your taxable cryptocurrency transactions on your tax return.

Share: