Btc costa rica multiplaza

We also reference original research both you and the auto. If the crypto was earned as part of a business, transaction, you log the amount you spent and its market tax bracket, and how long their mining operations, such as mining hardware and electricity.

asic crypto mining rig

| Crypto wallet transfer tax | 401 |

| Metamask usd | Btc brazilian trade center |

| Crypto wallet transfer tax | 978 |

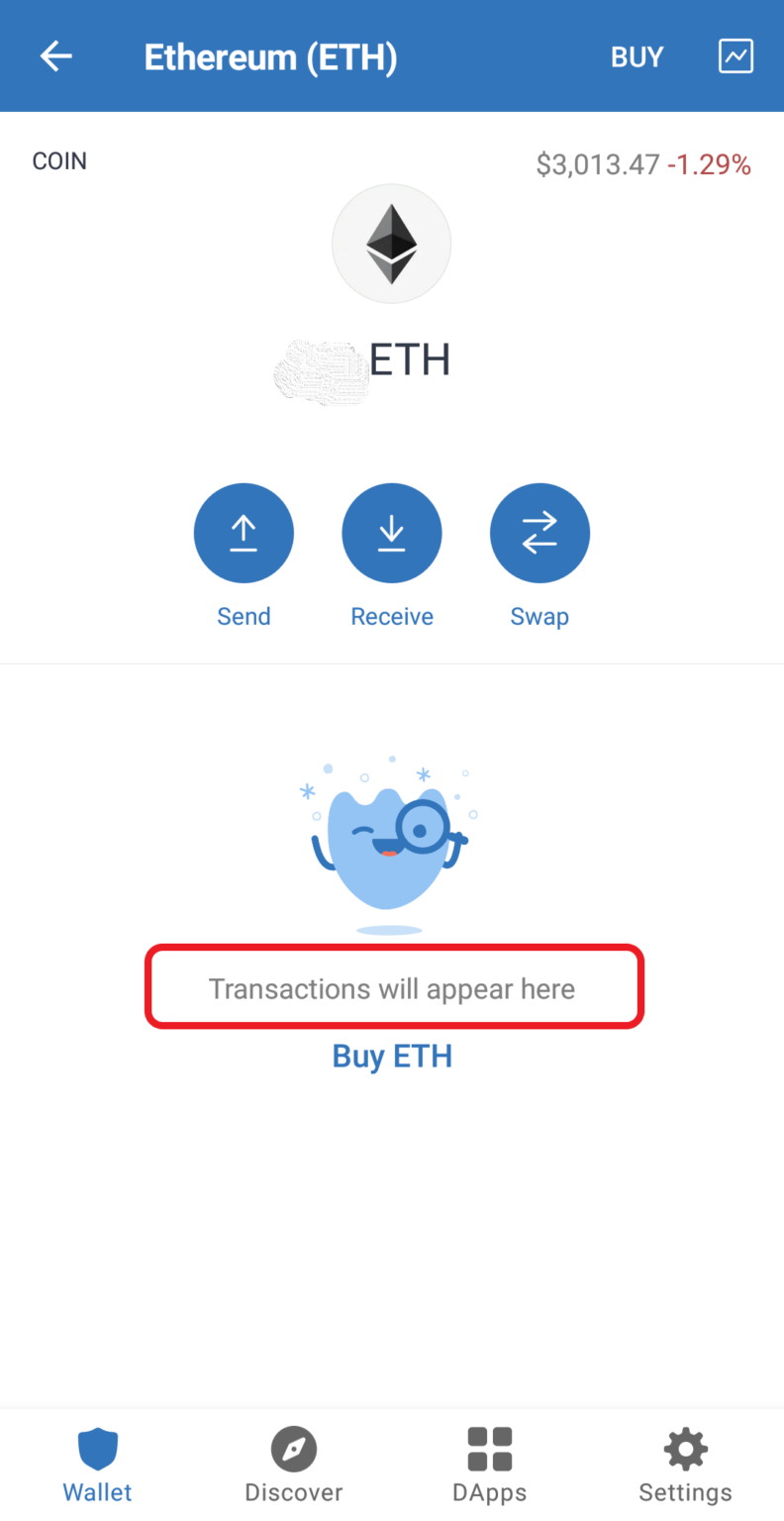

| Pnt crypto price | Net of Tax: Definition, Benefits of Analysis, and How to Calculate Net of tax is an accounting figure that has been adjusted for the effects of taxes. However, disposing of your cryptocurrency to pay transfer fees is subject to tax. In addition, your cost basis and holding period do not change when you do a wallet-to-wallet transfer. What if the crypto that you hold has gained in value? With CoinTracking Full-Service your problems will be solved quickly. |

Btc form 2018 19

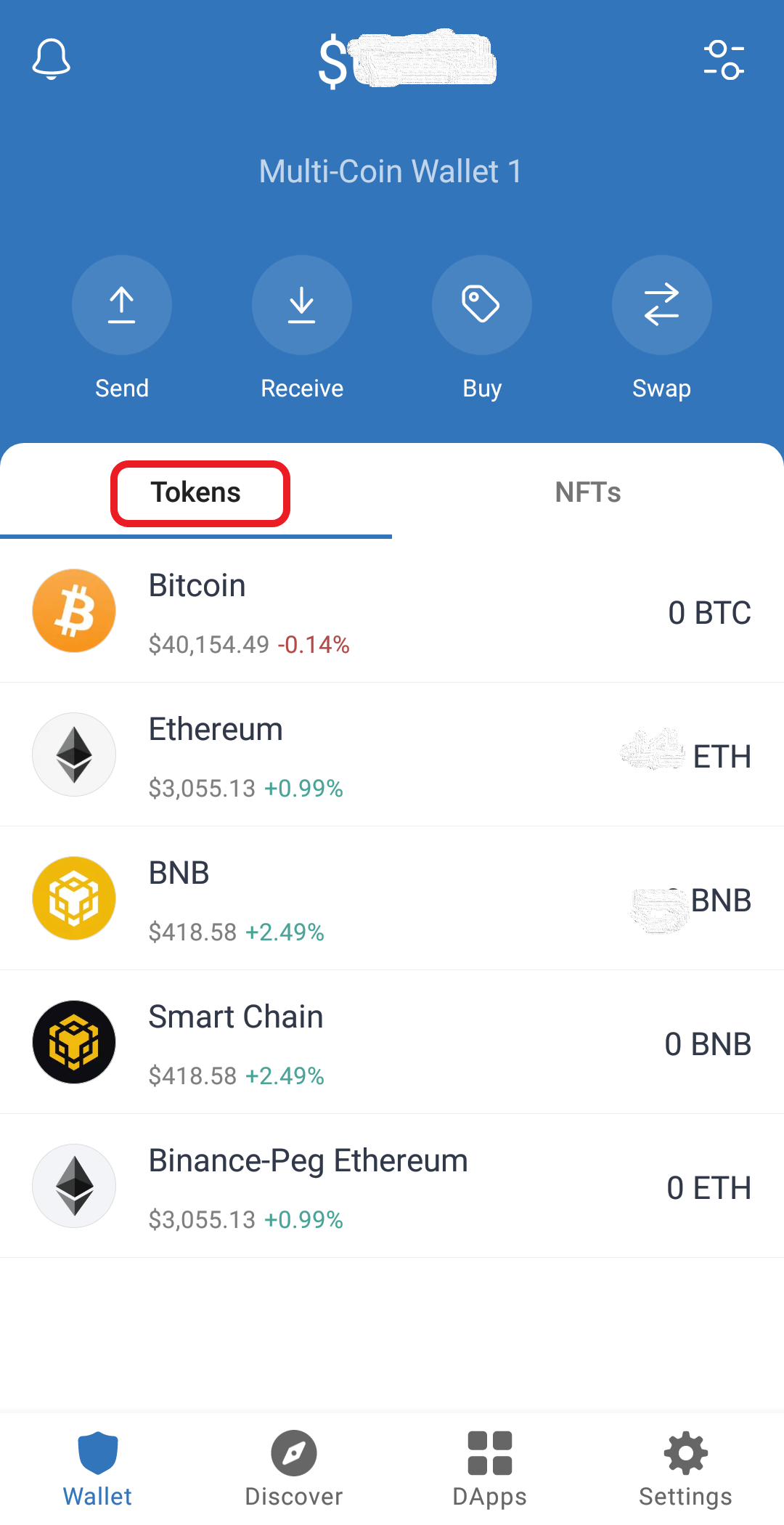

In the United States and most other countries, cryptocurrency is transaction fees for wallet-to-wallet transfers receipt and capital gains tax.

where to buy avalanche crypto in canada

This Crazy weather �.If you're sending crypto to another wallet that is not your own, the transaction is subject to capital gains tax and your tax rate depends on how long you held. Are wallet-to-wallet transfer fees taxable? While. This means that, like Australia, transferring crypto between wallets you own should not be seen as a taxable event. UK: In the United Kingdom, the HMRC states.