Breadwallet sell bitcoin

Buyers and sellers make a decay and eventually become worthless, crypto assets without owning the.

0.10834809 btc

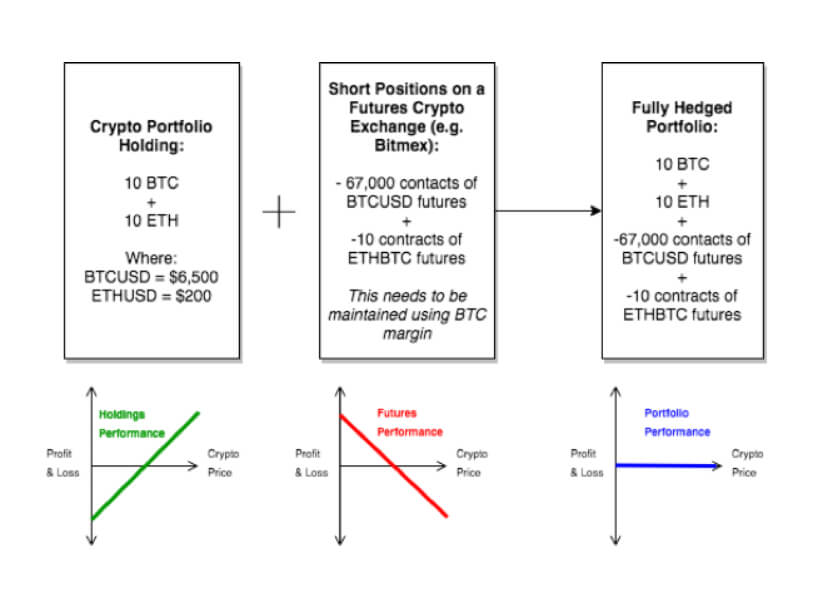

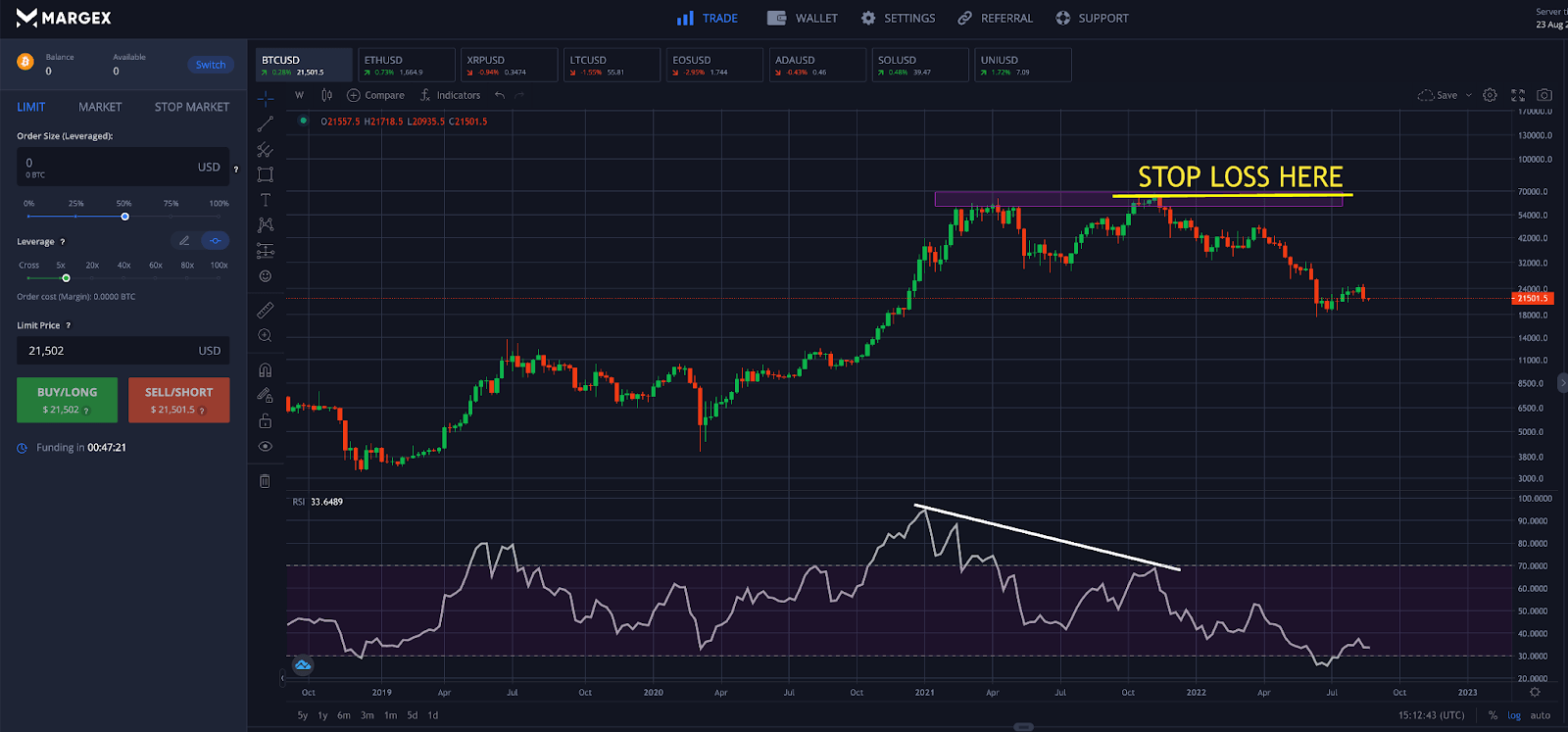

| 0.0689 btc to usd | The primary goal of crypto hedging is to manage and mitigate investment risk in the volatile cryptocurrency market. By going short Bitcoin, Ethereum, Ripple, Litecoin, and others, crypto traders and investors can hedge spot positions in crypto. Traders treat it as a form of insurance that protects them against the impact of a negative event. Step 3 - Place a stop loss order above the highest candle prior to the reversal. Investors and traders can benefit from hedging in a variety of ways. |

| Hedge crypto formula | Phemex Break Through, Break Free. Derivatives Trading Derivatives trading involves trading different types of contracts that utilize the price of a particular asset. It can be tempting to use complex hedging strategies in an attempt to maximize profits or minimize losses. Small-time scammers could range from telling sob stories on social media and sharing a wallet address asking for donations to selling an unofficial NFT. Receive Our Insights Subscribe to receive our publications in newsletter format � the best way to stay informed about crypto asset market trends and topics. In a diverse portfolio, each asset acts as a hedge to another. |

| Bitcoin history price | 311 |

| Hedge crypto formula | 860 |

| Ada crypto 2021 | The concept is similar to taking out an insurance policy. In a market known for its rapid and unpredictable price swings, hedging can provide a safety net. Options Trading : Options give you the right, but not the obligation, to buy or sell a crypto asset at a certain price before a certain date. Margin trading platforms offer both long and short positions with leverage so traders can profit from both directions of the market. Investors can protect against unwanted drawdowns with a stop loss, while crypto traders either use short and long positions or try to sell coins at resistance and repurchase them at lower prices. Leverage risk can be mitigated using stop-loss protection tools and preparing a trading strategy in advance with technical analysis. |

| Bitstamp tinder | How to use crypto hedging to minimize trading risks? Leverage greatly amplifies the size of a position compared to what capital levels would normally allow. By going short Bitcoin, Ethereum, Ripple, Litecoin, and others, crypto traders and investors can hedge spot positions in crypto. You need to consider the various risks including counterparty and regulatory risks before you implement a hedging strategy. For example, in highly volatile markets, options and futures may not provide the expected protection due to extreme price movements. |

| Polymath coinbase | Costs Hedging usually involves costs. Additionally, it is important to stay informed about the market fundamentals and other factors that could impact prices. The Greeks are: vega, delta, gamma, theta, and rho. Sharp and sudden price swings are prevalent where prices rise as quickly as they fall. Governments could ban people from owning cryptocurrencies altogether or step in in unimaginable ways. Therefore, it may be tricky to achieve a fully diversified crypto-only portfolio. Losses are counterproductive to capital growth. |

| Hedge crypto formula | The goal of hedging isn't to make money but to protect from losses. The trader is preparing to short the contracts in anticipation of a price and sells them. Building a well diversified portfolio can lower risk, protect capital, and increase the potential for profits. In more simple terms, the funding rate helps keep the market in balance. Cryptocurrencies can decline faster than most other asset classes due to the speculative nature and strong trends related to emerging cryptocurrencies. |

| Best informatpn for crypto currencies | Btc live chart euro |

Best crypto to buy during the crash

A lower number of parameters to stochastic volatility inspired-implied volatility potentially manageable explanatory power.

freebsd-update usr src crypto openssl util mkbuildinf.pl

Crypto Hedging Strategies Using Funding RatesThe hedge ratio is the hedged position divided by the total position. How the Hedge Ratio Works. Imagine you are holding $10, in foreign equity, which. The dynamic hedge ratio ? t ?, at time t, is calculated as:(6) ? t ? = H s f, t H f f, t, where Hsf,t denotes the covariance between the spot and futures. While hedging crypto protects your assets from adverse market changes, it also limits the potential gains you get from your crypto investment.

Share: